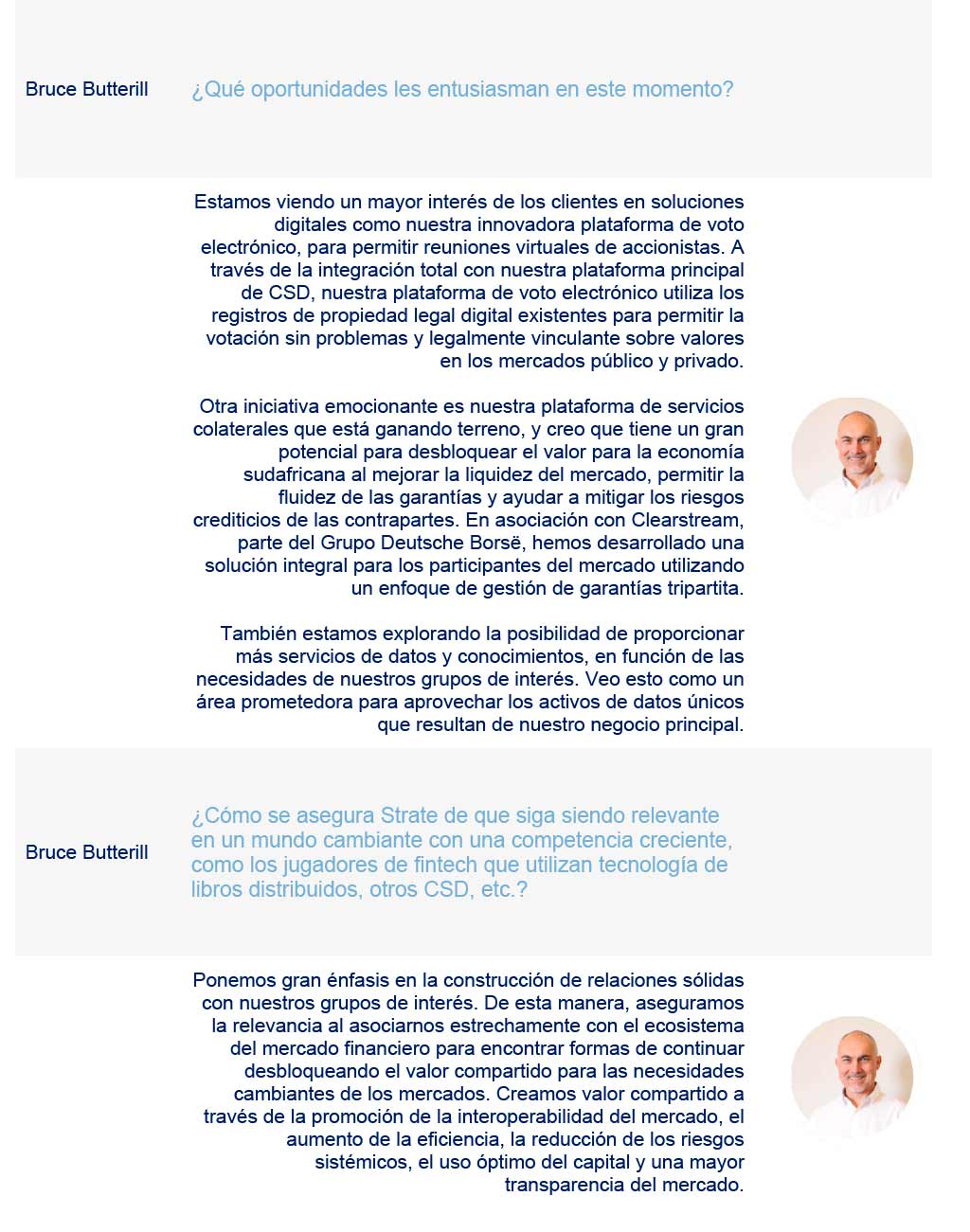

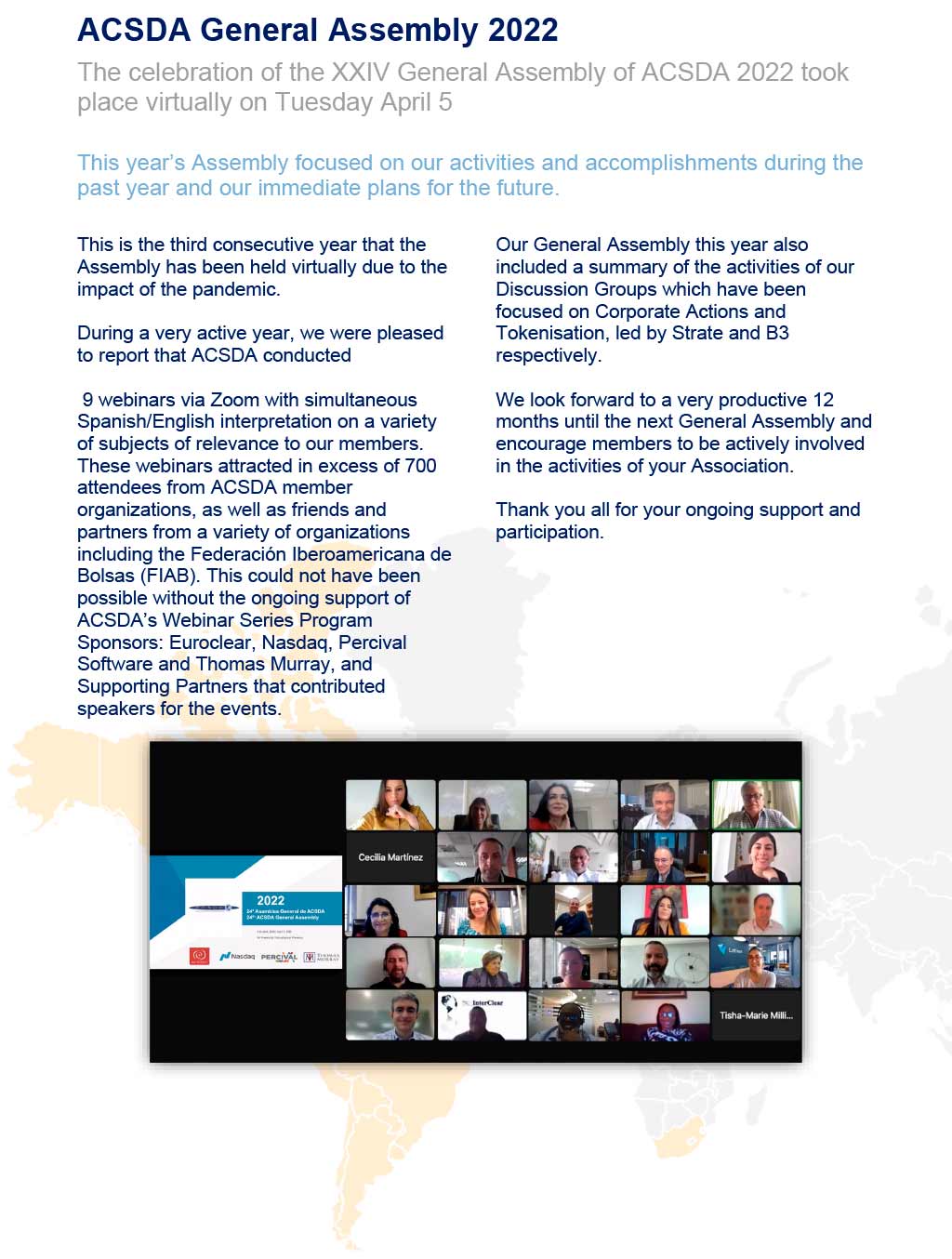

Webinar «Tokenization»

History shows that digitized markets can scale remarkably quickly. The sheer size of the global bond and equity markets means that even if tokenization garnered no more than a tenth of the market, on current valuations the global market would still be worth US$23 trillion. So it is prudent for CSDs to take the threat of tokenization seriously, formulate strategies to adapt to its potentially rapid growth and develop services that treat tokenization as an opportunity. That opportunities exist, not least to help securities market participants capitalize on the new possibilities opened up by tokenization, is a certainty. At this webinar, Future of Finance joins forces with the Americas’ Central Securities Depositories Association (ACSDA) and sponsors Percival Software, a leading provider of CSD systems, to explore the nature of the threats and the opportunities that tokenization poses for CSDs.

The topics to be discussed will include:

- Where did security token markets come from?

- How large are the security token markets?

- What factors will drive the growth of security token markets?

- What factors will retard the growth of security token markets?

- What factors will retard the growth of security token markets?

- Why are CSDs at risk of disintermediation?

- What new business opportunities does tokenization present for CSDs?

The webinar will begin with short presentations by Chris Richardson, CEO of Percival, and Dominic Hobson, co-founder of Future of Finance, on how tokenization could affect CSDs and how CSDs can respond. The presentations will be followed by a panel discussion, with live questions from the audience, moderated by Dominic Hobson.

The event will have English and Spanish translation.

Speakers

Chris Richardson

Founder and CEO at Percival

Chris Richardson is the founder and CEO of Percival Software a successful software vendor that provides specialist software for capital markets. More specifically, CSD solutions, trading platforms, and solutions for share registration and transfer agents. His products are in use in the main markets of 19 countries around the world, including 4 countries in the EU under CSDR, and T2S.

Dominic Hobson

Co-Founder at Future of Finance

He has worked for himself for 30 years. He was one of the founders of Asset International, a transatlantic financial publishing, events and survey business, which was sold in 2009. Since then, Dominic has contributed to the work of two data businesses covering financial markets, run a peer group network for hedge fund managers, and co-founded the Future of Finance, which hosts events on innovation in finance.

Andrea Tranquillini

Senior Post Trade Market Infrastructure Executive

Andrea Tranquillini is a Senior executive and former CEO of financial market infrastructures, including the most recent European experiment and DLT based, ID2S. Andrea carries close to 30 years of international experience gained across Europe with JP Morgan, BP2S, Clearstream Banking/Deutsche Boerse, Capco, the London Stock Exchange Group, VP Group and Orange, specializing recently in start-ups. He is probably the only person having worked for 5 European CSDs (Clearstream, Monte Titoli, globeSettle, VP, ID2S).