WFC 2015

S.D. Indeval, the Mexican central securities depository within the Bolsa Mexicana de Valores (BMV) Group, had the honor of hosting the 2015 World Forum of CSDs – WFC 2015, in Cancun from May 19 to 22. With more than 230 attendees from 80 countries participating, the forum united all sectors of the post-trade market infrastructure industry, including not only CSDs, but clearing houses, regulators, central banks, leading service providers, global banks and custodians.

Indeval represented the Americas’ Central Securities Depositories Association (ACSDA) as host of the 13th global conference, which has been held every two years in a different region since 1991.

On Tuesday, May 19, the five regional associations from Africa and Middle East, Americas, Asia-Pacific, Eurasia and Europe that comprise the WFC, as well as several other industry groups, met in pre-conference sessions. This was followed by an early Wednesday meeting of those regional associations’ leadership on the WFC Executive Board.

At 11 a.m. on Wednesday, WFC 2015 Conference was officially called to order in the imposing Tulum Salon of the JW Marriott Hotel, which had been transformed with a dramatically lit soundstage design featuring the conference’s colorful logo.

With ACSDA’s Executive Director Bruce Butterill, as Master of Ceremonies opening the WFC 2015 agenda and with Jaime Ruiz Sacristan, Chairman of Grupo BMV, who introduced the host keynote speaker, Jaime Gonzalez Aguadé, Chairman of the Comisión Nacional Bancaria y de Valores (CNBV), Mexican securities and banking supervisor, who addressed the impacts of new regulations on the financial market. Also opening the session and welcoming the delegates were WFC President Eddie Astanin Chairman of the Executive Board of National Securities Depository, Russia, and ACSDA President Jorge Hernán Jaramillo, Chief Executive Officer of Deceval, Colombia.

Fernando Yañez, CEO of DCV, Chile introduced the second keynote, presented by Jaime de la Barra, Partner of Compass Group, setting the global stage for WFC 2015 with a sweeping world tour of economic and market trends in both developed and developing markets.

Panel 1, moderated by Rose Mambo, Chief Executive Officer of Central Depository & Settlement Corporation Ltd., Kenya and panelists Mathias Papenfuss, Chairman – ECSDA, Member of the Executive Board – Clearstream, Daniel Thieke, Managing Director and General Manager Settlement and Asset Services – DTCC, USA, Lum Yong Teng, Senior Vice President, Head, Depository Services – Singapore Exchange, and Göran Fors, Head of GTS Banks, SSC Member – SEB, Sweden, featured a lively discussion on settlement systems’ experience and challenges in shortening their trade settlement cycles. Europe, which reached a unified Trade Date +2 (T+2) settlement timing in a big-bang approach last October, shared its experience, noting the importance of regulatory coordination. Other regions discussed taking more of a building-block approach. The US is targeting its move to (T+2) for the third quarter of 2017. All agreed that managing fails and liquidity are critical factors.

Collateral management proved a compelling topic for Panel 2, given CSDs’ responsibilities as secure, central hubs and in providing efficient securities movements and asset servicing to enable their member banks and other financial institutions to meet regulatory mandates worldwide to strengthen their securities and cash reserves in the post-financial crisis reforms. The panel, moderated by Michael Barrett, Vice President – Genpact Headstrong Capital Markets, USA and panelists Alessandro Zignani, Head of Sales – LSE Group, Italy Monica Singer, CEO – Strate, South Africa, and Stephan Pouyat, Global Head of Capital Markets – Euroclear discussed a variety of collateral management models and services.

In the conference’s third keynote, introduced by Jose Oriol Bosch CEO of the Mexican Stock Exchange, Dr. Lorenza Martinez Trigueros, Managing Director of the Bank of Mexico, outlined the strategic partnership that the Mexican central bank and Indeval have built. She highlighted the unique benefits gained through their innovative integration of payment and securities settlement that enables Mexico’s financial market infrastructure to settle daily transactions valued at USD 230 billion.

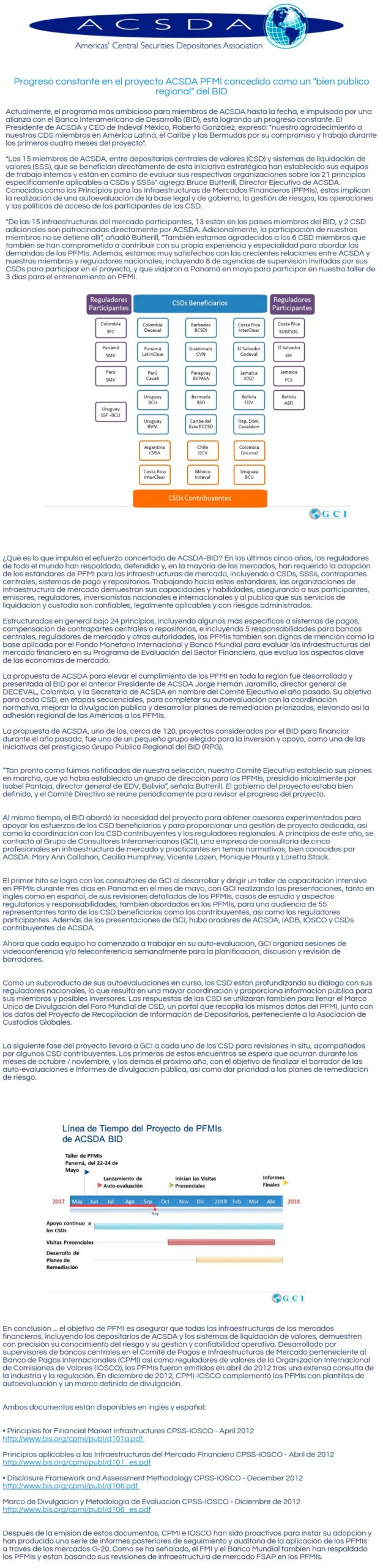

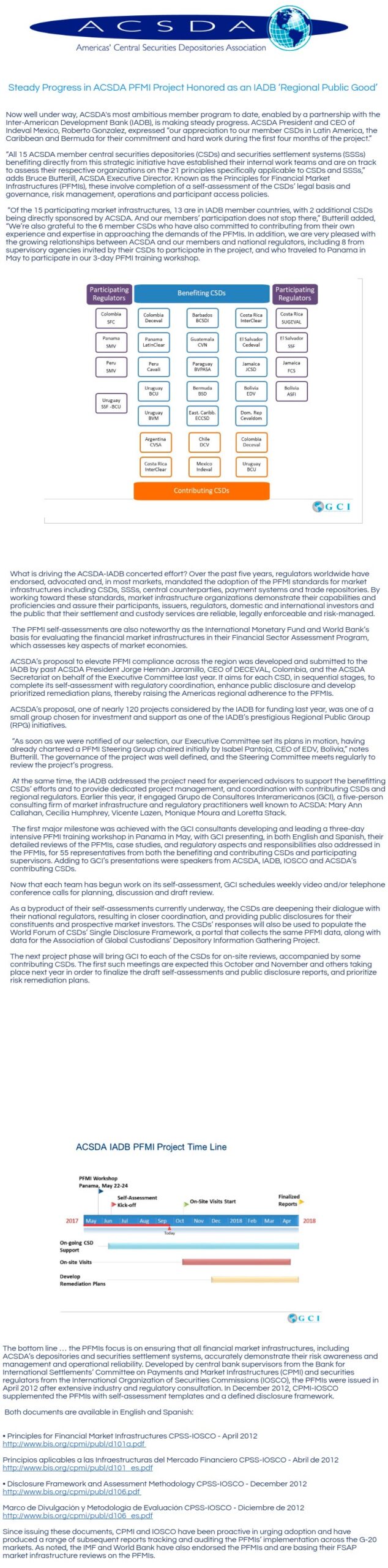

In Panel 3, moderated by Soraya Belghazi, Secretary General – ECSDA and panelists Froukelien Wendt, Senior Financial Sector Expert – International Monetary Fund, David Stanton, Chief Risk Officer – CDS – Canada and Eduardo Flores Herrera, VP Exchange Supervision – Comisión Nacional Bancaria y de Valores – Mexico, focused on the industry’s progress in understanding, self-assessing and implementing the CPMI-IOSCO Principles for Financial Market Infrastructures (PFMIs), the set of 24 risk-based standards for market infrastructures jointly defined by central banking and securities regulators in the aftermath of the financial crisis. With the PFMIs as key focus for CSDs as well as in payment systems, central counterparty clearing systems and trade repositories. This panel traced progress relating to the principles which are designed to raise the bar in each jurisdiction. The PFMIs also represent the key global ratings criteria in the International Monetary Fund/World Bank Financial Sector Assessment Program.

Moderated by Jorge Hernán Jaramillo, CEO – Deceval, Colombia, and panelists Arturo del Castillo, Partner – KPMG, Colombia and Mark Clancy, CEO – Soltra; Chief Information Security Officer – DTCC, USA, panel 4’s experts showed the massive impact cyber threats pose to the financial industry and the preventive measures that CSDs and other stakeholders are implementing to prevent losses.

Next Panel 5, moderated by Simon Thomas, CEO – Thomas Murray, UK and speakers George Zinner, Director Capital Market Services – OEKB, Austria, Mohammad Hanif, CEO – CDC – Pakistan, Urs Staehli, Secretariat – ISSA, Switzerland and Gennadiy Zhurov, CEO – National Depository of Ukraine discussed asset protection, debating pros and cons of the various settlement account models currently operated by CSDs.

Panel 6, the last on Thursday, moderated by Vivekanand Ramgopal, Vice President – Tata Consultancy Service, showcased CSD winners of WFC’s Innovation Contest, with wide-ranging products from Turkey’s virtual shareholders’ meetings presented by Gokce Iliris, Head of International Relations – MKK; Colombia’s dematerialized promissory notes, by Jorge Hernán Jaramillo, President and CEO – Deceval – Colombia; South Africa’s propose web portal for training CSD staff globally by Monica Singer, CEO of Strate Ltd.; Euroclear’s adaptation of its pan-European investment funds system to address domestic market funds, by Danny Missotten, Director – Corporate Strategy & Business Development; and Korea’s extension of its funds services to address pensions by Jaehoon Yoo, Chairman and CEO – KSD – Korea.

CSD spending in technology development is growing at a rate of 7% per year beyond 2017. During the Technology Panel 7 moderated by Carlos A. Patiño, Director of Business Development, Latin America & Caribbean, Calypso and speakers Kelley Mavros, Vice President – Strategy&, USA, Henri Bergström, Head of Global Post Trade Solutions – NASDAQ OMX, Finland and G.V. Nageswara Rao, Managing Director & CEO – NSDL, India, discussed drivers behind this growth, the potential to leverage CSD data, expand beyond core services and support regulatory changes as well as the arrival of potentially more globalized technologies such as blockchain.

The impact of regulation on CSD activities was a recurrent comment throughout all panels. Experts on panel 8, moderated by Benjamin Smith, Partner – Oliver Wyman Financial Services and panelists Paul Symons, Head of Public Affairs – Euroclear, Marc Bayle, Director General, Market Infrastructure & Payments – European Central Bank and Sergey Shvetsov, First Deputy Governor – Bank of Russia discussed how new regulation, on one hand, creates opportunities for CSDs to expand their services as banks, facing financial and regulatory pressures, may be more open to outsourcing in order to offer solutions such as, collateral management, risk management and reporting. On the other hand, regulatory requirements pose challenges in terms of the economic viability of CSDs, which is driving to greater consolidation. Regulators also face challenges in addressing Financial Market Infrastructure risks and complying with global standards.

CSD collaboration resulting in successful efforts was presented during panel 9. Moderated by Chris Church, Chief Executive Americas and Global Head of Securities – SWIFT, CSDs gave clear examples of their productive experience. Speakers, Jesus Benito, CEO – Iberclear, Spain, Jian Liu, Senior Business Manager – CSDC, China, Tanya Knowles, Head of Projects, Innovation and Business Services – Strate, South Africa and Eddie Astanin, Chairman of the Executive Board – NSD, Russia highlighted key elements for success in a partnership among CSDs, including leadership, trust and sustainability.

The conference’s final panel, featuring Valérie Urbain, CEO – Euroclear Bank, Jeffrey Tessler, CEO – Clearstream, Murray Pozmanter, Managing Director and Head of Clearing Agency Services – DTCC, Lee Waite, Global Head of Direct Custody & Clearing, Citi Transaction Services – CITI and Gottfried Leibbrandt, CEO – SWIFT and moderated by Josef Landolt, CEO – ISSA, revisited many of the challenges and opportunities posed throughout the conference and offered a hopeful vision for the future of CSDs and other market providers. Consolidation and industry collaboration was a common view to the future landscape for CSDs.

Indeval’s CEO Roberto Gonzalez Barrera followed his closing remarks in which he thanked the speakers, sponsors and delegates, by presenting the WFC’s engraved silver plate to Asia-Pacific’s 2017 joint host organizations: Central Depository Company of Pakistan Limited, China Securities Depository & Clearing Corporation Ltd., Hong Kong Exchanges and Clearing Limited, and National Securities Depository Limited, India, who extended their video invitation to WFC 2017 in Hong Kong.

WFC 2015 Conference also offered attendees outstanding networking and social events: Wednesday’s Welcome Cocktail Reception overlooking the Caribbean, hosted by Grupo BMV and Indeval; Thursday’s Gala Dinner and Show sponsored by SWIFT and set in Xcaret, a former Mayan reservoir, and the waterfront views of Friday’s closing waterfront barbecue at Pok-ta-Pok Club. Delegates also enjoyed lunches generously sponsored by TCS, Thomas Murray and GlobeTax. Attendees enjoyed generous coffee breaks sponsored by Clearstream and AMEDA, and more than 60 delegates were up at 6:30 a.m. to participate in the Thursday Fun Run sponsored by Euroclear.

Other conference amenities were graciously provided to WFC 2015 by Calypso, Percival, Deutsche Bank, ECSDA, AECSDA and ACSDA.